nh meals tax payment

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. A 9 tax is assessed upon patrons of hotels and restaurants on meals alcohol and rooms costing 36 or more.

Pin By Bellshomestead On Planning Our Homestead Food Protection Prepared Foods Things To Sell

From there you can register or log into your.

. The employer must also maintain on file a copy of the written notifications for pay and fringe benefits signed by the employee RSA 27549 and New Hampshire Administrative. A tax is imposed on taxable meals based upon the charge therefor as follows. 603 230-5945 Contact the Webmaster.

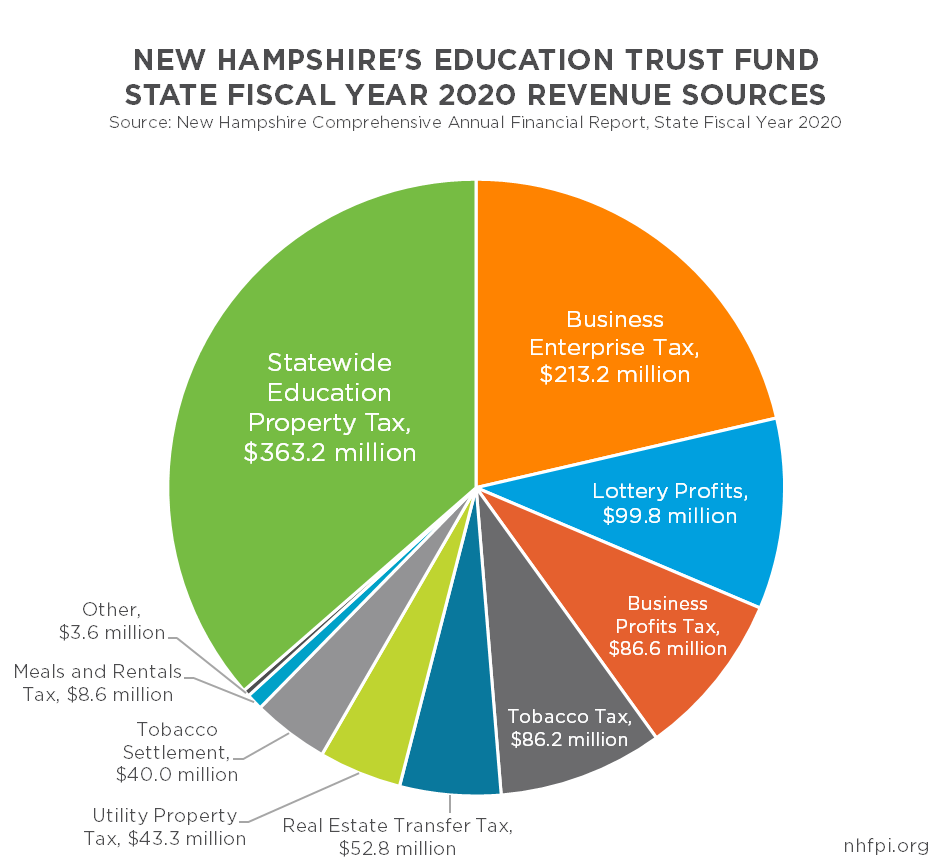

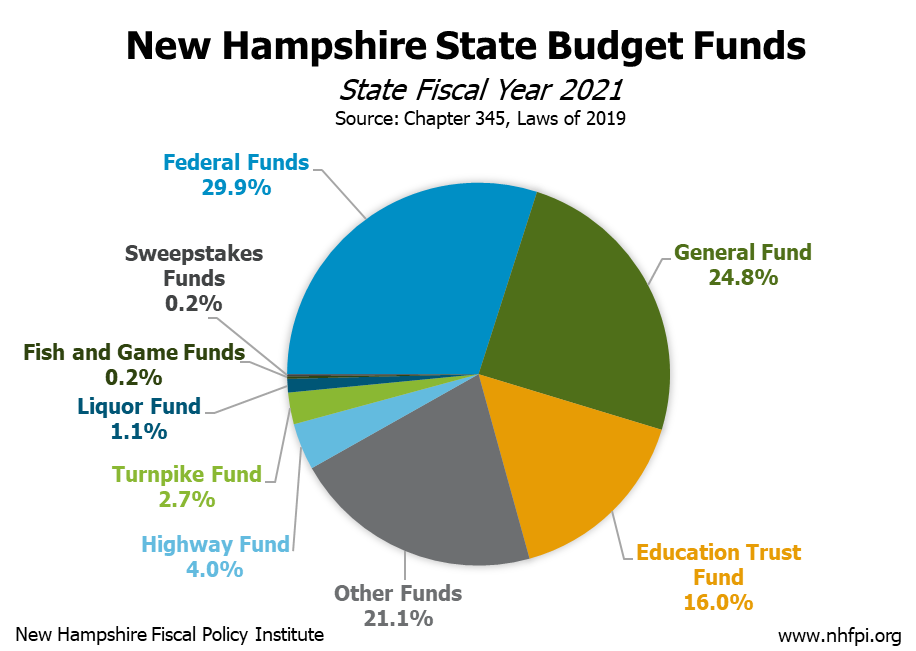

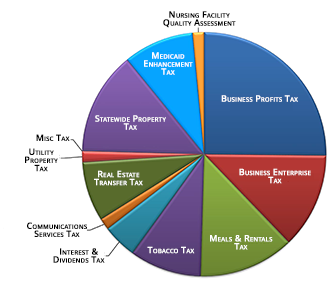

For a complete list of payments by city and town. 2022 New Hampshire state sales tax. It lists information on general sales taxes.

E-file fees do not apply to NY state returns. Yes employers must provide in writing an employees rate of pay at the time of hire and upon any changes as well as all policies pertaining to any fringe benefits. The NH Department of Revenue Administration has made it easier to file your Business Enterprise Taxes Business Profits Taxes Interest Dividends Taxes Meals Rentals Taxes and Real Estate Transfer Taxes online using Granite Tax Connect.

Before August 1 2009 the tax rate was 5 Generally food products people commonly think of as groceries are exempt from the sales tax except. Yes most NH taxes may be paid online. 603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301.

There are however several specific taxes levied on particular services or products. 1350 per proof-gallon or 214 per 750ml 80-proof bottle. Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the customer receipt or check.

A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. 1800 per 31-gallon barrel or 005 per 12-oz can. A proof gallon is a gallon of.

A Four cents for a charge between 36 and 37 inclusive. Federal excise tax rates on beer wine and liquor are as follows. Be sure to visit our website at revenuenhgovGTC to create your account access today.

Enter your total tax excluded receipts on line 1 excluded means that the tax is separately stated on the customer receipt or check. The tax is 625 of the sales price of the meal. Failure to comply with state and local tax laws can result in fines and interest penalties.

If I dont collect this tax I can be forced to pay the tax penalized and put into other legal jeopardy. New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access Relay NH. Exact tax amount may vary for different items.

B Five cents for a charge between 38 and 50 inclusive. Elderly Services Town Of Plaistow Nh Registering with the dor. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax.

Use the link on the left side of page Payment Options to make a payment on-line by credit card or e. Please mail TAX PAYMENTS ONLY to the following address. A 9 tax is also assessed on motor vehicle rentals.

Twenty-eight states allow vendor discounts most with caps of 25 to 500 per month. NH Department of Revenue Reminds Taxpayers of Meals and Rooms Tax Rate Reduction. 625 of the sales price of the meal.

Go to httpswwwrevenuenhgovgtcindexhtm. 603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. Meals and Rooms Operators.

The State Treasury has completed its annual meals and rooms tax distribution to New Hampshire cities and towns for state fiscal year 2022. Accordingly New Hampshire is listed as NA with footnote 11. Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85.

Tax authorities require short-term vacation rental hosts to collect applicable short-term rental taxes from their guests and remit them to the proper authorities. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. Please visit GRANITE TAX CONNECT to create or access your existing account.

A tax of 85 percent of the rent is imposed upon each occupancy. Tax Returns Payments to be Filed. The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations.

Like hotel and BB stays short-term rentals in New Hampshire are subject to tax. Multiply this amount by 09 9 and enter the result on Line 2. Find Out Today If You Qualify.

An immediate concern is the opportunity this creates for fraudulent efforts to gain business information or even seek payment of fraudulent tax bills. The New Hampshire State Treasury delivers professional financial management services to state government the legislature and New Hampshire citizens. Meals furnished by an operator to its employee for which the employee is required to pay a charge either by the cost being withheld from the employees wages or by actual payment shall be subject to tax based on the amount deducted or paid by the employee.

New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. New hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Under New Hampshire State law I am now obligated to collect the 9 Meals Rooms MR tax for the NH Revenue Administration. NH imposes a 9 percent tax on meals and rooms with a 3 percent vendor discount.

DOJs first course of action will be to make. They should also notify the New Hampshire Department of Justice DOJ by calling its Consumer Information Line at 888-468-4454 or 603-271-3643. New Hampshire is one of the few states with no statewide sales tax.

107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content. This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as of January 1 2022.

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

24 Salmon Meadow Lane Moultonborough Nh Lake House Patio Lake Winnipesaukee

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Legislation Reduces Corporate Taxes Eliminates Personal Income Tax Albin Randall And Bennett

Everywhere Kids Eat Free In Nh Kids Eat Free Eat Free Children Eating

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Pin By Park Inn By Radisson Gurgaon B On Park Inn Radisson Bilaspur Happy Family Meals Food

Sununu S Pitch To Suspend Rooms And Meals Tax Worries Nh Town Officials

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax States

Usborne Books More Usborne Books Usborne Books

Favorite Maine Recipes Poster Excuse The Comic Sans Font I Ve Got Maine On The Mind Maine Food Recipes

Early Impacts Of The Covid 19 Crisis On State Revenues New Hampshire Fiscal Policy Institute

New Hampshire Meals And Rooms Tax Rate Cut Begins

Nh Business Tax Money May Slow Down Soon Manchester Ink Link

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

Transparency Nh Department Of Revenue Administration

New Hampshire Income Tax Nh State Tax Calculator Community Tax