rhode island income tax rate 2021

Income tax rate schedule. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

Ri Tax Credits Financing Rhode Island Commerce

The rate so set will be in effect for the calendar year 2020.

. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. Your 2021 Tax Bracket To See Whats Been Adjusted.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750. See what makes us different. Income Tax Calculator 2021 Rhode Island 102500.

Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax. Any income over 150550 would be taxes at the highest rate of 599. Exemption Allowance 1000 x Number of Exemptions.

Uniform tax rate schedule for tax year 2021 personal income tax Taxable income. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the extended filing due date of October 17 2022. Rhode Island Income Tax.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax. 51 rows Rhode Island Income Tax Calculator 2021. Which was 5950 for 2020 will be 6000 21.

For those earning more than. Phase-out range for standard deduction exemption amounts by tax year 2020 2021. Find and Complete Any Required Tax Forms here.

The interest rate on delinquent tax payments has been set at eighteen percent 18 per annum. Detailed Rhode Island state income tax rates and brackets are available on this page. Ad Compare Your 2022 Tax Bracket vs.

2022 Child Tax Rebate Program. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by. A simplified Tax Calculator for HOH Single and Married filing Jointly or Separate.

If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. 207700 to 231500 210750 to 234750.

The current tax forms and tables should be consulted for the current rate. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. Rhode Island Tax Brackets for Tax Year 2021.

Rhode Island Division of Taxation - Page 3 of 5. Discover Helpful Information And Resources On Taxes From AARP. Find your gross income.

Of the on amount Over But Not Over Pay Excess over 0 66200. Terms used in the Rhode Island personal. Start filing your tax return now.

If you make 140000 a year living in the region of Rhode Island USA you will be taxed 32198. Ad Get Ready for Tax Season Deadlines. Over But not over Pay percent on excess of the amount over 0 66200 -- 375.

However if Annual wages are more than 231500 Exemption is 0. 4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax. If youre married filing taxes jointly theres a tax rate of 375 from 0 to 66200.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1. 3 rows Tax rate of 375 on the first 68200 of taxable income.

If you make 70000 a year living in the region of. Your average tax rate is. TAX DAY NOW MAY 17th - There are -469 days left until taxes are due.

We dont make judgments or prescribe specific policies. Tax rate of 475 on taxable. The rate so set will be in effect for the calendar year 2021.

DO NOT use to figure your Rhode Island tax. If you make 75000 a year living in the region of Rhode Island USA you will be taxed 12418. Your average tax rate is.

The income tax is progressive tax with rates ranging from 375 up to 599. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding. Income Tax Calculator 2021.

Levels of taxable income. Interest on overpayments for the calendar year 2021 shall be at the rate of three and one-quarter percent 325 per annum. Rhode Island Income Tax Calculator 2021.

Income Tax Calculator 2021 Rhode Island. In Rhode Island theres a tax rate of 375 on the first 0 to 66200 of income for single or married filing taxes separately. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

Rhode Island Income Tax Calculator 2021.

Rhode Island College Official Bookstore

Historical Rhode Island Tax Policy Information Ballotpedia

How To Set Up An Llc In Rhode Island 2022 Guide Forbes Advisor

Pass Through Entity Election Ri Division Of Taxation

Top States For Business 2022 Rhode Island

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Calculator Smartasset

The Most Outspoken Member Of The R I Senate Has A Target On His Back And A Primary Opponent In His District The Boston Globe

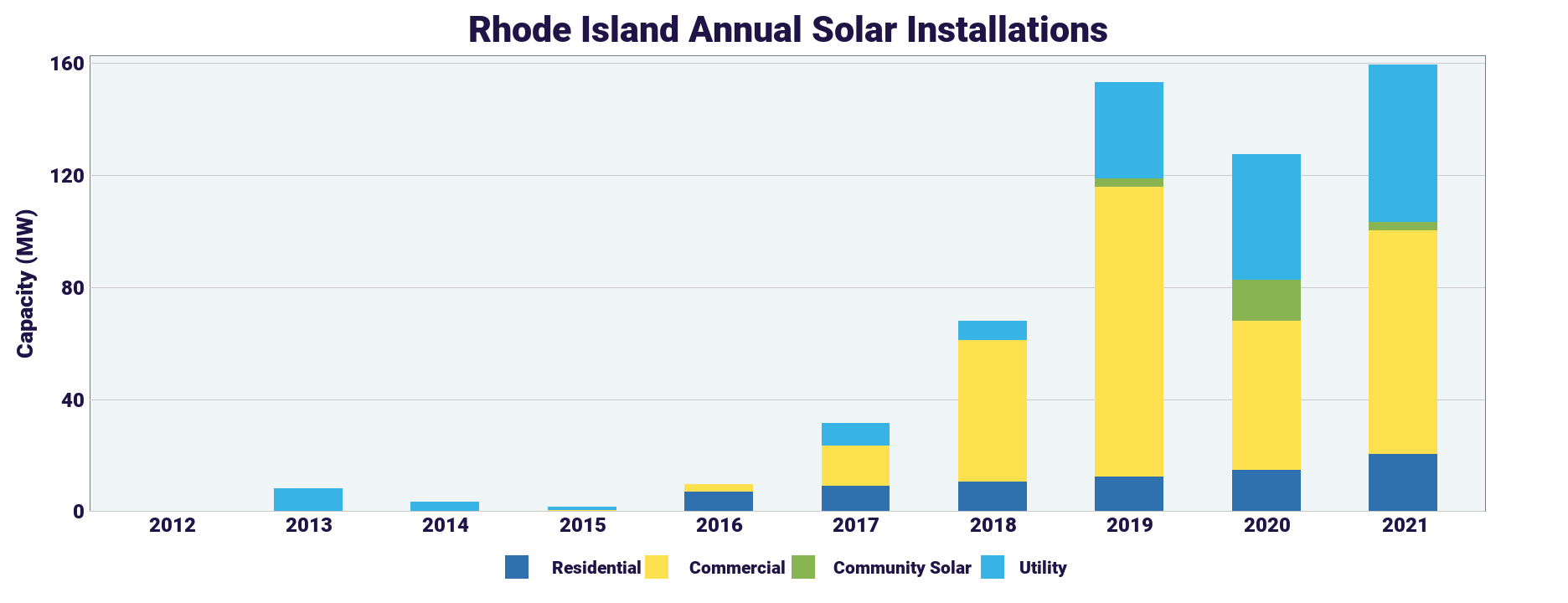

Rhode Island Limits Solar Power Property Taxes Pv Magazine Usa

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

Best Criminal Justice Schools In Rhode Island

Rhode Island Income Tax Brackets 2020

Discover 20 Of The Most Interesting Facts Of Rhode Island Economic Ones Too

Ri Food Bank Status Report On Hunger Rhode Island Community Food Bank

/bostonglobe-prod.cdn.arcpublishing.com/resizer/lQYx3z1oHya0po0ZdjKhbeFK4CY=/1024x0/filters:focal(1493x10:1503x0)/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/W4AJ2Y3RSRHLXNKJMNLYENPYDQ.jpg)